Summary

Label | Description |

|---|---|

| Business Process | Student Self-Service |

| Module | Student Financials |

| BP ID | |

| Prerequisites | Student should have access to the student portal mySDCCD and not yet consented to receive the 1098-T Tax form electronically. |

| Description | This Job Aid illustrates how a student consents to receive his/her 1098-T Tax form electronically. |

| Info | ||

|---|---|---|

| ||

Instructions:

STEP | Instructions |

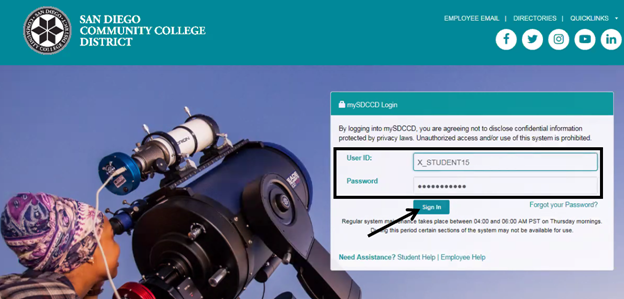

1) | The student logs into mySDCCD at: https://myportal.sdccd.edu. |

STEP | Instructions |

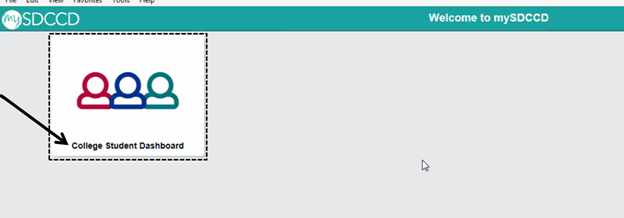

2) | Click the “College Student Dashboard”. |

STEP | Instructions |

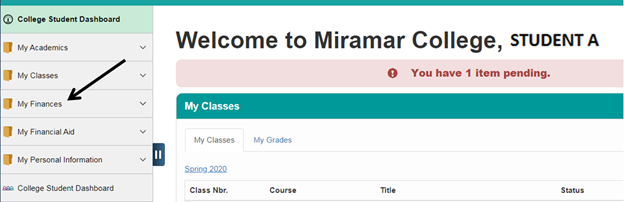

3) | On the left navigation, click “My Finances”. |

STEP | Instructions |

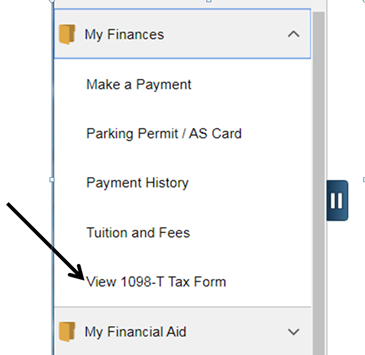

4) | On the left navigation menu, click “View 1098-T Tax Form”. |

STEP | Instructions |

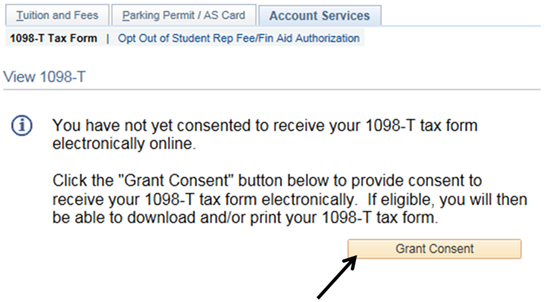

5) | Read the 1098-T information. Click “Grant Consent”. |

STEP | Instructions |

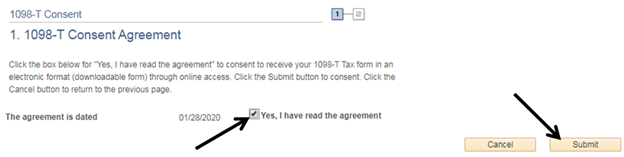

6) | Click the box next to “Yes, I have read the agreement” to acknowledge having read the 1098-T Consent Agreement. A checkmark will appear in the box. Click “Submit” |

STEP | Instructions |

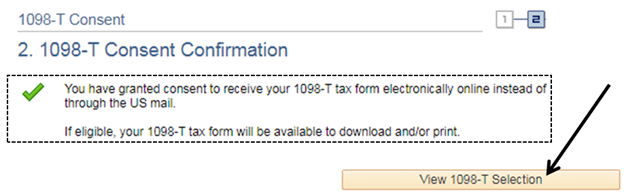

7) | The system will confirm the student’s choice via a checkmark. Click “View 1098-T Selection”. |

STEP | Instructions |

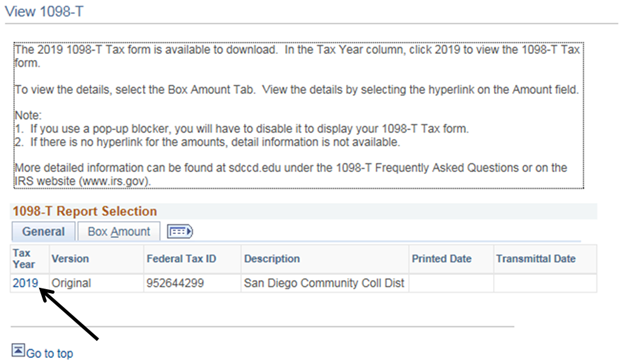

8) | On the “General” tab, under the “Tax Year” column, click the year. In a separate window, a PDF version of the 1098-T tax form will be displayed, which can be downloaded and printed. IMPORTANT: If you use a pop-up blocker, you will have to disable it to display your 1098-T Tax form. |

STEP | Instructions |

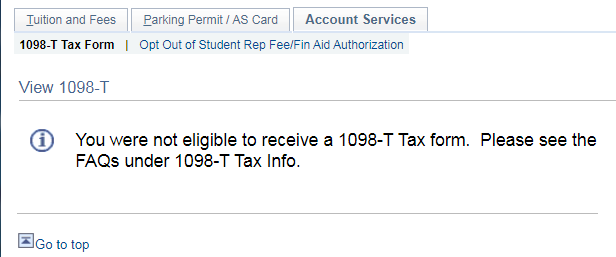

8A) | Note: While it is possible for students to consent to receive the 1098-T Form electronically, they may not be eligible for one at the time of consent. In a case like this, the following notice will appear if a student tries to view the 1098-T Tax Form. |

End of Procedure |